Christine George

Tech

3

min read

Nov 18, 2023

As a rule, everyone is super careful when it comes to their belongings; we keep our keys close and our phones closer. Since digital payments became the norm, this extends to our online assets. But how do we keep something safe when we can’t even hold it? Enter digital wallets.

Wallets play a vital role in securely managing your digital assets, and when it comes to trading on DEXs, having a reliable and secure wallet is of paramount importance. Two popular types of wallets are custodial and non-custodial wallets; let's explore the differences between these wallets and how they empower traders in the exciting realm of decentralised trading.

Custodial Wallets: Trusting Others with Your Assets

As the name suggests, custodial wallets involve entrusting your digital assets to a “custodian” or a third party. When you create such a wallet, you essentially hand over the responsibility of safeguarding your assets to the custodian. These wallets are usually provided by cryptocurrency exchanges or other service providers; prominent examples include Binance, Coinbase and Kraken.

One of the primary advantages of custodial wallets is their convenience. They often offer user-friendly interfaces, making it easier for beginners to navigate the complex world of cryptocurrencies. Additionally, custodial wallets may provide additional services such as fiat-to-crypto conversions, trading, and customer support.

However, convenience comes at a cost. By relying on a custodial wallet, you relinquish control over the private keys that grant you access to your funds. In other words, the custodian has complete control over your assets. And although custodial wallets employ adequate security measures, the risk of hacks, theft, or mismanagement of funds is still present.

Pros Cons Easy recovery: In case you lose your private keys, the custodian can recover it (after verifying your identity). Integration: They may enable fiat-to crypto conversions and provide access to NFTs through integration with other exchanges Support: Customer support and troubleshooting assistance are a huge plus of custodial wallets. Zero control: You have to trust an external entity to keep your assets safe. Centralised: Using a custodial wallet might be seen as contrary to the decentralised nature of crypto. Privacy: Users are required to provide personal information, and the storage and usage of this data may come under scrutiny.

Non-Custodial Wallets: Taking Control of Your Assets

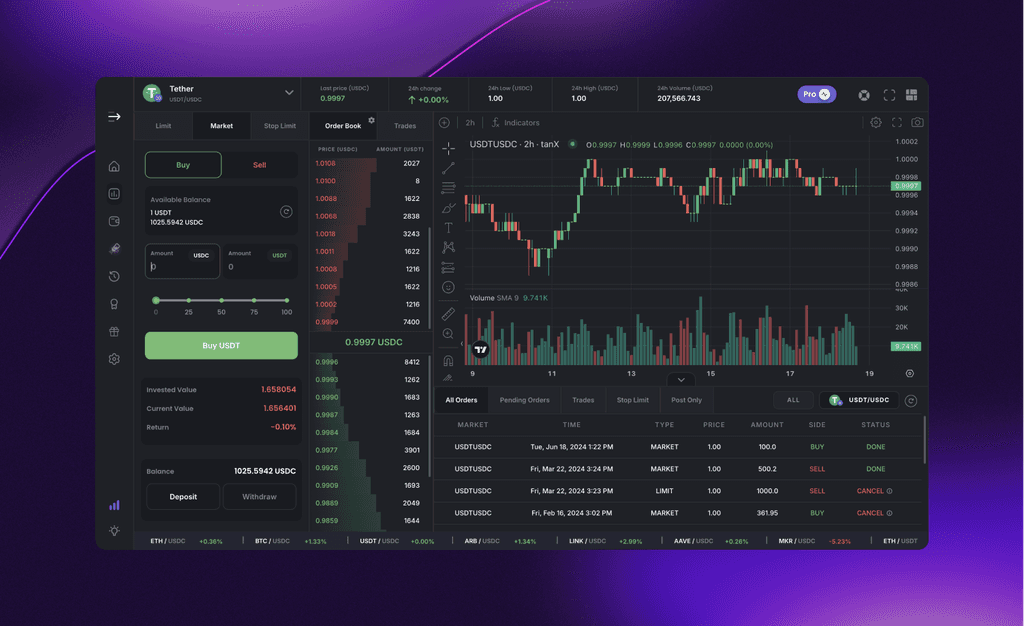

Non-custodial wallets are designed to allow individuals to manage their funds independently, without relying on third parties. With a non-custodial wallet, you are the sole owner of your private keys, which means that you have full authority over your assets at all times. Examples of non-custodial wallets include Metamask, Uniswap and of course, tanX.

The major advantage of non-custodial wallets is the enhanced security and control they offer. Since you control your private keys, the risk of unauthorised access or theft is significantly reduced. Non-custodial wallets often employ encryption techniques and advanced security measures to protect your funds, providing peace of mind to traders.

On the other hand, the responsibility of securing your funds lies completely on your shoulders when it comes to non-custodial wallets. Moreover, the UI may be more difficult to use for novice traders and transaction delays may slow things down.

Pros Cons Autonomy: You have full control over your assets at all times. Economy: There are little/no custodial fees involved, compared to custodial wallets Privacy: There is no KYC requirement so users don’t have to disclose personal information. Responsibility: If your private keys are lost or compromised, you could lose your funds. Complexity: They may be trickier to use, thus less user-friendly, especially for beginners. Processing delay: More steps for transaction confirmation can result in longer processing times.

Non-Custodial Wallets and DEX Trading: Superb Synergy

Non-custodial wallets and DEX platforms are a perfect match, as they are in alignment on the core principles of decentralisation, security, and privacy. By using a non-custodial wallet, you retain ownership and control over your assets while enjoying the benefits of trading on a DEX.

Trading on a DEX with a non-custodial wallet further enhances security and privacy. Decentralised exchanges operate on blockchain technology and do not hold custody of your funds. Instead, trades occur directly between users through smart contracts. When connected to a non-custodial wallet, you can securely access the DEX, manage your digital assets, and execute trades directly from your wallet interface. This streamlined process reduces the reliance on centralised exchanges, minimises the risk of hacks, and ensures that you remain in control of your funds throughout the trading journey.

The Final Word

In conclusion, choosing the right wallet is crucial for securely managing and accessing your digital assets. Custodial wallets offer convenience and support but come with potential security and privacy trade-offs. Non-custodial wallets provide users with control, security, and privacy, but require more technical know-how and personal responsibility. Ultimately, the decision between custodial and non-custodial wallets depends on individual preferences, risk tolerance, and the desired level of control over one's crypto holdings. Regardless of the choice, it's essential to prioritise security measures, such as strong passwords, two-factor authentication, and regularly backing up private keys.

Get Started with trading on the world's leading insto DEX right away!