Ram Kumar

Product

4

min read

Sep 7, 2024

Over a hundred countries are developing Central Bank Digital Currencies (CBDCs), which could significantly impact the crypto industry. So it’s important that we understand CBDCs, which countries have launched them, what roles they can play, and how they can impact crypto and DeFi.

Key Objectives of this blog

Define CBDCs

Explore the benefits and use-cases of CBDCs

Explore the challenges of CBDCs

Discuss how CBDCs may affect DeFi

What are CBDCs?

CBDC stands for Central Bank Digital Currency. It’s issued and controlled by central banks, and it may either be the digital form of an existing currency or a separate legal tender. It’s different from cryptocurrencies because CBDCs are issued and controlled by the central bank whereas cryptocurrencies are from private entities.

Are stablecoins and CBDCs the same?

CBDCs are similar to stablecoins, but they are not the same. CBDCs are issued by Government entities and controlled by them, whereas stablecoins are cryptocurrencies pegged to real-world assets and are issued by private entities.

How do CBDCs work?

The explosive growth of digital finance is a product of digitalisation, and with crypto becoming increasingly relevant, CBDCs can be a great way for a government to encourage, adopt and guide this industry to find the best use cases. It can be used to buy any goods or services in the country, provided users have access to a phone and internet connection.

CBDCs can be built with or without using blockchain technology. There are primarily two types of CBDCs:

Retail CBDC: A form of CBDC used by consumers and businesses. It is of two forms - those that offer anonymity and those that don't.

Wholesale CBDC: A type of CBDC for financial institutions that facilitates interactions between them and the government on issues like monetary policies and inflation.

Which country has launched CBDCs?

Many countries are experimenting with CBDCs. According to the Atlantic Council’s CBDC Tracker, three countries have launched CBDCs, about three dozen countries have launched pilot programs and over a hundred countries are experimenting with it.

The countries with their own CBDCs are:

The Bahamas launched Sand Dollar Currency in October 2020.

Nigeria launched eNaira in October 2021.

Jamaica launched JAM-DEX currency in July 2022.

What are the advantages of CBDC?

CBDCs offer several advantages:

Financial Inclusion: The biggest advantage of CBDCs is ease of access—anyone with a phone and internet connection can access their funds. According to a 2021 World Bank report, about 1.7 billion adults worldwide don't have bank accounts. If implemented effectively, CBDCs could provide a significant portion of the world's population with better access to financial services (like how The Bahamas did).

Affordable and Quick: CBDCs can potentially make financial transactions more affordable and quicker, especially across borders. And cheap, accessible and quick alternatives always see mass adoption.

Infrastructure: The infrastructure required to implement CBDCs is simple because they eliminate the need for third party intermediaries and they also reach the unbanked population easily.

CBDCs can incentivise the adoption of crypto. This means that crypto’s innovative solutions and technologies also reach a larger audience.

CBDCs can encourage economic growth due to their accessibility, low operating cost, etc.

What are the challenges in implementing CBDCs?

Overcoming CBDC’s challenges is crucial to realise its true potential.

Cybersecurity: One of the biggest threats to DeFi are the constant security breaches and hacks. And CBDCs could prove to be a threat to the government if they fail to prevent these attacks.

Infrastructure: While CBDCs can increase financial inclusion, they require robust infrastructure to support a large user base. This system should also integrate seamlessly with the existing banking system to ensure smooth operations.

Existence of Alternatives: Currently, some countries argue that payment tools like Swift and UPI make CBDCs redundant.

Global Collaboration: Global collaboration and friendly monetary policies are a must for CBDCs to work well internationally.

Effect of Monetary Policies and Economy: Since the concept of CBDCs is relatively new, it’s unclear how monetary policies will affect CBDCs, and how it will impact the economy and its cashflow.

Privacy: Central banks have the option to make both CBDCs (ones where users are anonymous, and other where they aren’t) and what each bank decides to do will affect the respective CBDC’s adoption, and crypto users are more likely to lean toward CBDCs that promise anonymity.

(Stanley is us towards CBDCs that don’t promise anonymity.)

What do CBDCs mean to DeFi and crypto as a whole?

Simply put, the answer isn’t simple.

CBDC and DeFi share similar features like financial inclusion, interoperability, incentivising innovation, etc. while they clash over factors related to regulation and compliance, decentralisation, etc. But different countries will take different approaches to CBDCs - and crypto users will respond accordingly.

What may work well for DeFi industry is: n mn

Opportunities: CBDCs that can support and nurture crypto will help increase innovation.

Reach: More people will be able to access crypto easily.

Investment: More money flowing into the industry = more potential investors = increased innovation.

The future of finance will be a combination of both DeFi and CBDCs. The crypto industry brings decentralisation, security, and innovation, while proper regulation, guidance, and compliance laws from world banks and governments can help harness the best of both worlds. Although this future is distant, we have come a long way since the birth of crypto. With over a dozen countries working on laws to regulate crypto to foster innovation and many more experimenting with digital currencies, it is safe to say -

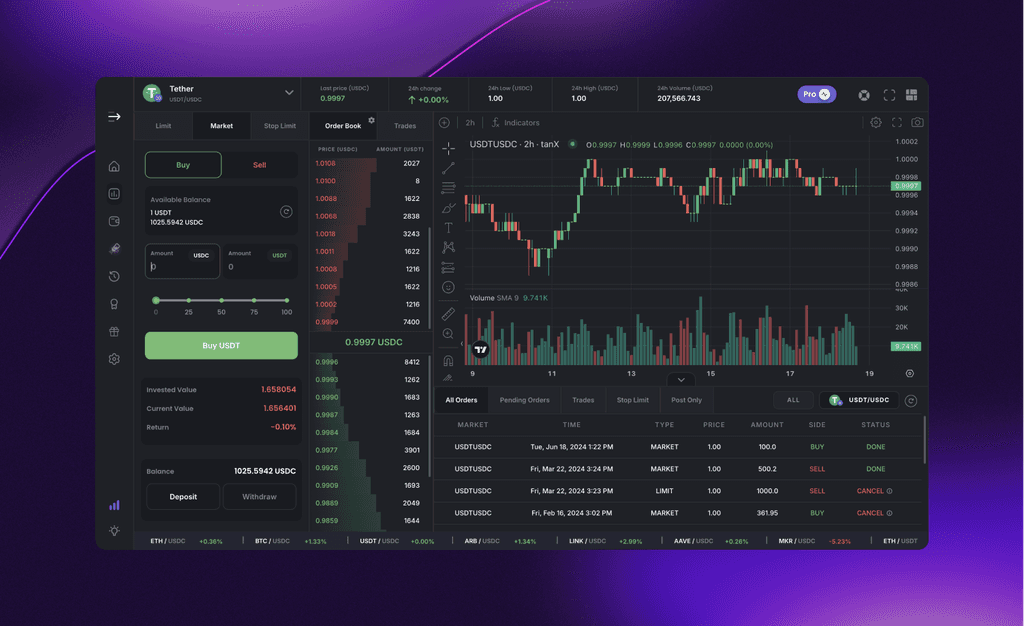

Get Started with trading on the world's leading insto DEX right away!