Christine George

Industry

3

min read

Oct 23, 2024

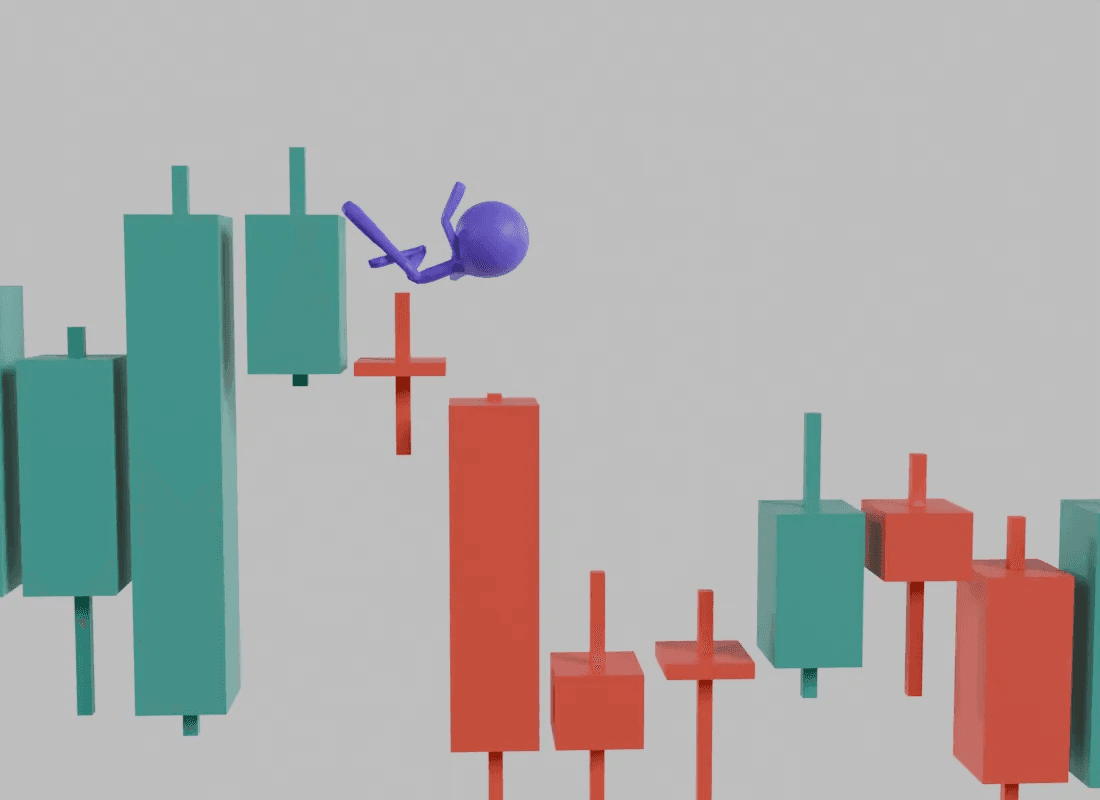

You've spent hours analysing the market, identified a perfect trade opportunity, and executed it with precision. But instead of the expected profit, you find your trade has slipped, leaving you with a loss. This is known as slippage.

What is Slippage?

Slippage is a common phenomenon in trading, where a difference occurs between the expected price of a trade and the actual price at which it is executed.

For example, imagine you want to buy shares of a stock priced at $100 per share. You place a market order, hoping to buy at the current market price. However, due to high market volatility, the price might have risen by the time your order is executed, leading you to pay $102 per share instead. This difference of $2 per share is slippage.

Slippage can be positive or negative. depending on how favourable it is for you. Positive slippage is when the price difference moves in your favour; for instance, your order gets executed lower than expected in a long position. Negative slippage is when the price movement works against you; for example, your order gets executed at a higher price in a short position.

Types of Slippage

Slippage can occur in various forms, and understanding these types is crucial in managing risk and optimising strategies.

Here are some types of slippage:

Market-order slippage occurs when a market order is placed and the price of the asset moves significantly while the order is being filled. For example, if you place a market order to buy a stock during a period of high volatility, the price might rise by the time the order is executed, leading to negative slippage.

Stop-loss and take-profit order slippage occurs when a stop-loss or take-profit order is triggered, but the price moves so quickly that the trade is executed at a price different from the intended one. This can happen, for instance, during a flash crash or a gap up opening.

Limit-order slippage occurs when a limit order is placed at a certain price, but the price moves so quickly that the order is not filled at the specified price. For example, if you place a limit order to sell a stock at a certain price, but the price drops sharply before the order can be filled, you might miss out on the sale.

Weekend slippage occurs when a position is held over a weekend, and the price of the asset moves significantly during the time the markets are closed due to events that occurred during the period. For example, if a major news event happens during a weekend, the price of a related asset might go up or down when the markets reopen on Monday.

What causes slippage?

Slippage can occur in both buying and selling transactions, and it depends on several factors:

Market Volatility: Fluctuations in prices can cause slippage, especially for large orders.

Order Type: Market orders are more susceptible to slippage (compared to limit orders) because they are executed at the best available price at the time of the order, whether that is higher or lower than the market price.

Order Size: Larger orders can lead to more slippage as they can influence the market price.

Trading Platform: Different trading platforms may have varying execution speeds, which could affect slippage.

Real-World Examples of Slippage

While slippage is common in financial markets, certain incidents have stood out due to their magnitude or the lessons they've taught. Here are a few notable examples:

The Flash Crash of 2010: on May 6, 2010, the Dow Jones Industrial Average saw a sudden and dramatic drop of nearly 1000 points in just a few minutes. This plunge was said to be caused by a combination of factors, including algorithmic trading and market volatility. The rapid price fluctuations led to significant slippage for investors who were unable to execute trades at their desired prices, resulting in substantial losses.

The Knight Capital Group Incident of 2012: In August 2012, Knight Capital Group, a major U.S. market maker, suffered a catastrophic trading error that resulted in losses of nearly $440 million in a single day. The incident was caused by a software glitch that triggered a series of high-frequency trading algorithms, leading to excessive buying and selling. As a result of the rapid execution of these orders, Knight Capital Group experienced significant slippage, as the market was unable to absorb the large volume of trades.

The GameStop Short Squeeze of 2021: As retail investors coordinated to drive up the price of GameStop stock, hedge funds that had shorted the stock faced significant losses. The sudden surge in demand led to increased market volatility and slippage for traders attempting to exit their short positions. While not solely attributed to slippage, this incident highlighted the potential for slippage to exacerbate market volatility.

Slippage in Crypto Trading/Markets

Slippage is generally more common in crypto trading compared to traditional financial markets. This is due to the unique nature of the cryptocurrency market.

Crypto markets are known for their high volatility, and rapid price movements can lead to substantial differences between the intended and executed prices. Crypto markets often have lower liquidity as well, resulting in wider bid-ask spreads and increased slippage. Furthermore, many crypto exchanges operate on a decentralised basis, which can introduce additional factors that contribute to slippage, such as network congestion or technical issues.

Strategies to Minimise Slippage

While it's impossible to completely eliminate slippage, traders can take several steps to minimise its impact:

Be Aware of Market Conditions: Monitoring market trends can help you anticipate potential volatility and avoid trading during such unstable periods.

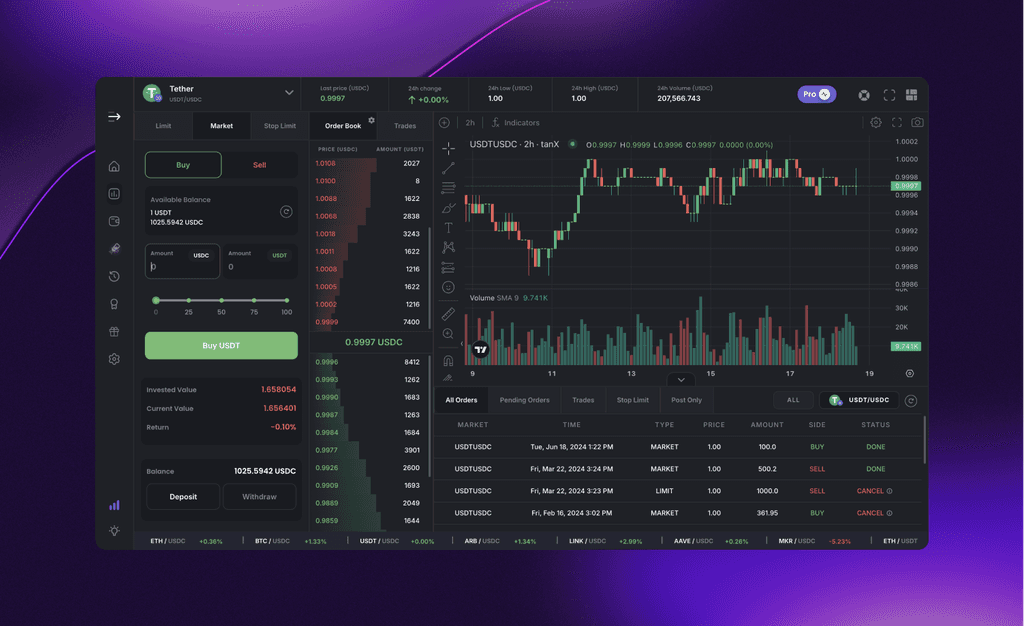

Use Limit Orders: Limit orders allow you to specify the maximum price you're willing to pay or the minimum price you're willing to sell at. This can help prevent slippage by ensuring you only execute trades at your desired price.

Reduce Order Size: Smaller orders are less likely to move the market, reducing the chances of slippage.

Choose a Reliable Exchange: A reliable trading platform with fast execution speeds and deep liquidity can help minimise slippage.

Slippage vs. Spread: What's the Difference?

Spread is another concept that can impact trading costs. It's the difference between the bid price (the highest price a buyer is willing to pay) and the ask price (the lowest price a seller is willing to accept). While slippage occurs after the order is executed, spread is built into the price at the time of the trade.

The Importance of Understanding Slippage

Slippage is an inevitable part of trading, but by understanding its causes and implementing effective strategies, you can reduce its impact on your profits. And by imbibing the information outlined in this guide, you can become a more informed and successful trader.

Happy trading!

Get Started with trading on the world's leading insto DEX right away!