Ram Kumar

Product

4

min read

Aug 30, 2024

If you Google what DeFi means and what the differences between TradFi (traditional finance) and DeFi are, you will be bombarded by articles that are biased towards one or the other side. But if what you want isn’t a TradFi vs DeFi article, but an unbiased explanation, you are at the right place. This article works like noise cancellation - it cuts out all the noise to bring you a clear and well-defined comparison.

Now, dig in!

What is TradFi and what is DeFi?

TradFi represents the conventional financial systems that have been in place for decades, DeFi offers a modern, decentralized alternative that leverages blockchain technology. This comparison explores the fundamental differences between these two approaches, highlighting their unique features and the impact they have on users.

Category 1: Control and Ownership

DeFi operates on the principle of decentralisation, meaning that no single entity has control over the entire system. This is achieved through the use of blockchain technology, where smart contracts automate processes without the need for intermediaries like banks or brokers. As a result, users have direct control over their assets, reducing the risk of censorship or interference by third parties.

On the other hand, TradFi is characterised by centralised control, where financial institutions act as intermediaries between users and their assets. This centralisation allows for regulatory oversight and consumer protection but also introduces the potential for censorship and the possibility of intermediaries taking control of users’ funds.

Category 2: Accessibility and Inclusion

DeFi shines in its ability to offer permissionless access to financial services. Anyone with an internet connection can participate, regardless of their location or financial background. This global reach allows for greater financial inclusion, providing opportunities to those who are typically underserved by traditional banking systems.

Conversely, TradFi often imposes barriers to entry, such as strict identification requirements, credit checks, and geographic limitations. These barriers can exclude large segments of the population, particularly those in developing countries or those with poor credit histories.

Category 3: Security and Trust

DeFi relies on smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. This system is designed to be immutable, meaning once a transaction is recorded, it cannot be altered. However, this doesn’t totally negate the risk of hacks - smart contracts are young and developing, and vulnerabilities in it can be exploited by hackers, which can result in significant financial losses.

TradFi is built on a foundation of regulation and insurance, offering a level of security and trust that has been established over time. Banks and financial institutions are subject to rigorous supervision, reducing the risk of fraud. However, this centralisation also makes TradFi systems attractive targets for large-scale fraud or corruption.

Category 4: Transparency and Accountability

DeFi operates on a public ledger, where all transactions are recorded and can be viewed by anyone. This transparency ensures that all participants have equal access to information, reducing the potential for fraud and increasing accountability. Additionally, DeFi systems are generally resistant to censorship, as there is no central authority that can alter the data.

In TradFi, transparency is often limited to credit histories and financial statements, which are accessible primarily to institutions rather than individuals. While this established infrastructure provides a level of trust, it also leaves room for corruption or manipulation by those in power.

Category 5: Fees and Costs

One of the significant advantages of DeFi is its potential for lower transaction fees. Without intermediaries, users can often conduct transactions at a fraction of the cost compared to TradFi systems. However, hidden costs, such as gas fees on certain blockchain networks, can sometimes offset these savings.

TradFi, on the other hand, is notorious for various fees charged by intermediaries, including transaction fees, service charges, and interest rates. These costs can quickly add up, making TradFi services more expensive for users, particularly for international transactions.

Category 6: Innovation and Speed

DeFi is at the forefront of financial innovation, with new projects and protocols being developed at a rapid pace. The open-source nature of DeFi allows developers from around the world to contribute, leading to faster transaction times and a continuous stream of new features and services.

In contrast, TradFi is often slower to innovate due to the established processes and regulatory requirements that govern traditional financial institutions. While this stability can be beneficial, it also means that TradFi is often less agile in responding to emerging trends and technologies.

Conclusion

The comparison between DeFi and TradFi highlights the stark differences between these two financial systems. While DeFi offers decentralisation, accessibility, and rapid innovation, it also comes with risks related to security and hidden costs. TradFi, on the other hand, provides stability, regulation, and a long-established infrastructure but is often hindered by centralisation, higher fees, and slower innovation.

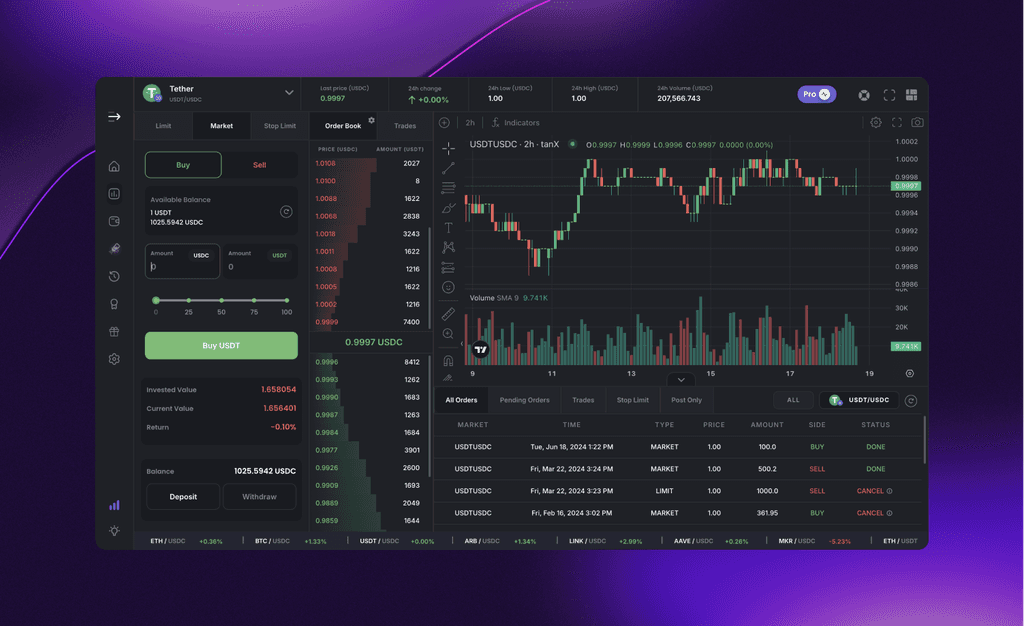

If you found out that DeFi is your cup of tea, then tanX might be the suitable DEX for you- it is an easy-to-use, gasless orderbook DEX that you can use to trade your crypto assets on. Learn more about tanX here or if diving in right away is your thing, trade now.

Get Started with trading on the world's leading insto DEX right away!