Christine George

Community

4

min read

Jun 21, 2024

Wanna know a quick and easy way to make money?

So would we! Who doesn’t love fast cash? But building lasting wealth is more like a marathon than a sprint; slow and steady is the way to go. For now, let’s talk about a safer way to earn profits while trading crypto.

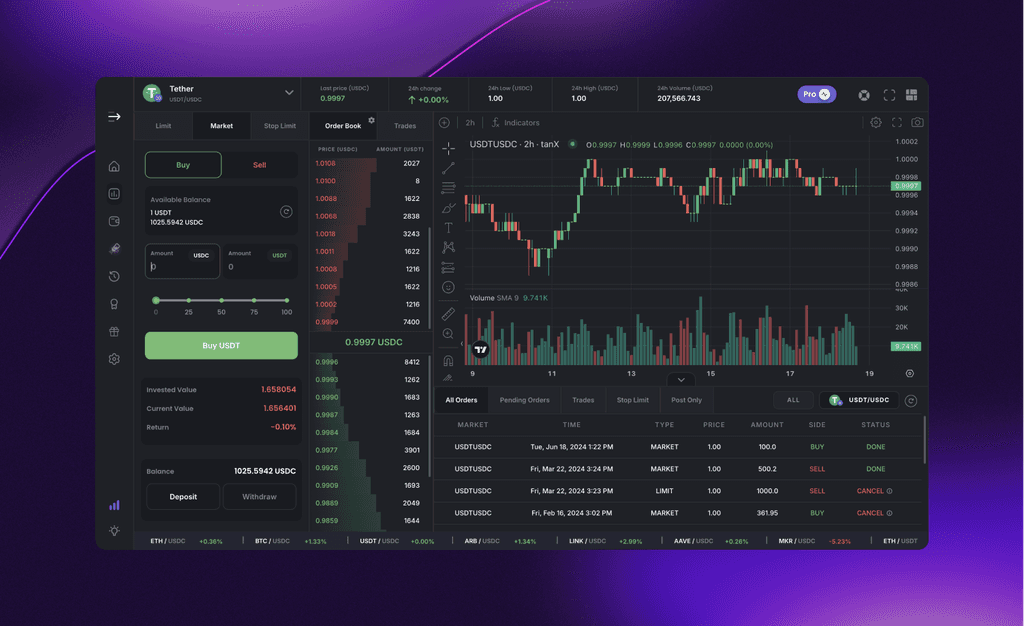

Crypto markets are known for their volatility, and this can be overwhelming for some traders. But for others, the volatility is a chance to make profits by playing the market and capitalising on price fluctuations. This is how day trading works - opening and closing positions within the same day. It’s an exciting concept, but let’s take a look at the strategies used, and the risks involved.

Day Trading: What is it?

Imagine buying tokens for $1000 after the market opens and selling it for $1400 before it closes 😯

This is day trading in a nutshell - capitalising on price movements within a single day to turn a profit. For those who enjoy the thrill of the game and have the time to actively monitor markets, day trading can be a exciting prospect.

Tactics for the Fast Lane: Types of day trading strategies

Day trading offers a unique set of challenges and opportunities, so adequate research is required to find a method that suits your risk tolerance and trading style. But with so much movement happening in a short time, how do you decide your approach?

This section looks at various day trading strategies and their core principles so you can find one that works for you. Here are a few examples to get you started:

Scalping is a strategy which focuses on making multiple small profits by taking advantage of tiny price movements that occur throughout the day.

Arbitrage is a type of scalping that seeks to profit from price discrepancies between exchanges, allowing you to buy low on one exchange and sell high on another.

Momentum trading involves identifying coins with a strong upward or downward trend and capitalising on that momentum by placing trades that align with the trend.

Reversal trading means identifying when a trend is about to reverse and take a calculated risk to profit from the switch.

Breakout Trading involves identifying when a token’s price is likely to surge past a certain level and capitalise on the expected jump.

Some of these terms might sound similar to each other because the core principle of day trading remains consistent, but there are subtle variations in entry/exit points that make them unique.

Risks are part of the Game

In a market as unpredictable as crypto, even the best strategies can go awry. Here are a few additional points traders should keep in mind:

Start small: While you may be eager to get started on your trading journey, it’s better to begin small by practicing your strategies via paper trading. This will ensure your life savings stay yours.

Avoid emotional trading: Don't let fear or greed cloud your judgment - come up with a strategy, stick to your plan and exit when necessary.

Be wary of volatility: Volatility is a double-edged sword; while it can definitely bring profits if utilised properly, but it can also lead to unexpected losses.

Have safety nets in place: Make sure you set stop losses to limit your potential losses and protect your capital.

Practice makes perfect: The more you study the markets and trade, the more techniques you will learn and be able to put into practice. This will eventually make you a seasoned trader.

Conclusion

Day trading can be a thrilling way to make money in the crypto market. However, it requires discipline, knowledge, and plenty of caution. If you're willing to put in the hard work and accept the risks, then crypto day trading might be for you. But remember: always start small, learn from the experts, and never trade assets you can't afford to lose.

Get Started with trading on the world's leading insto DEX right away!