Christine George

Industry

4

min read

Aug 18, 2023

A common challenge faced by DEXs is providing adequate liquidity for efficient trading, and that is where liquidity pools and market makers come in. You might have heard of these industry terms before, but what does it all mean? If you’re looking for a simple explanation, you’ve come to the right place. Let’s explore the significance of liquidity pools and market makers, and how they contribute to the functionality and efficiency of decentralised exchanges.

Liquidity pools - what are they and how do they work?

Let’s start at the beginning. Liquidity refers to the availability of buyers and sellers in a market, which allows assets to be bought and sold easily without drastic price fluctuations. And liquidity pools are virtual reserves of funds that facilitate trading in DeFi platforms by providing liquidity for specific pairs or assets. The more assets in the pool, the higher its liquidity.

Usually, when you want to trade one asset for another, there needs to be a ready buyer/seller in the market. Liquidity pools eliminate this requirement by using predetermined formulas which determine how much of each asset should be exchanged based on supply and demand ratios across different pools. They function based on an automated algorithm called an Automated Market Maker (AMM), which calculates prices based on the ratio of different tokens present in the pool. So when someone wants to trade a token, they don't need to wait for another person; instead, they can trade directly with the liquidity pool itself.

The people who contribute to liquidity pools are known as liquidity providers (LPs). In exchange for depositing their assets in these pools, LPs receive special tokens representing their ownership share within the pool, which can be traded and used within the platform. In addition, DEXs often incentivise providers by distributing governance tokens or platform-specific rewards based on their contribution. This is a win-win situation - LPs can earn passive income through these rewards and the platform is able to sustain a continuous supply of liquidity in the ecosystem.

Pros & Cons

Liquidity pools offer many merits to users including the following:

Transactional Efficiency: When using a liquidity pool, traders can execute transactions instantly without waiting to match with intermediaries. This means faster settlement times compared to centralised exchanges.

Reduced Slippage: In CEXs, large trades can cause slippage (difference between actual and expected trade price of an order) due to insufficient buyers/sellers at desired prices. Liquidity pools mitigate this issue by providing ample supply for trading volumes and ensuring the price is not affected by large trades.

Continuous Market Availability: Liquidity pools remain available around the clock, providing continuous access for swapping various tokens, even when traditional markets are closed.

Transparency: Due to their decentralised nature, liquidity pools promote transparency - all transactions are recorded on a public blockchain accessible by anyone.

Accessibility: Liquidity pools allow anyone to participate as liquidity providers, enabling individuals to contribute their tokens and earn passive income through transaction fees.

However, liquidity pools are not without risks; here are a few drawbacks:

Impermanent Loss: One major drawback is the risk of impermanent loss due to price volatility between tokens in the pool; this can result in reduced overall value compared to simply holding the tokens separately.

Smart Contract Risks: Interacting with DeFi protocols carries inherent risks due to potential vulnerabilities or bugs in smart contracts that manage liquidity pools; these risks could lead to loss or manipulation of funds.

Market Manipulation: In less regulated environments such as the DeFi space, there may be concerns regarding potential market manipulation if a few participants control significant portions of a particular liquidity pool.

Complexity: Participating in liquidity pools often involves complex processes and interaction with smart contracts; this can pose challenges for less experienced users.

TLDR - While liquidity pools offer earning potential and increased trading efficiency in DeFi ecosystems, they also come with risks such as impermanent loss and exposure to smart contract vulnerabilities. It is important to evaluate the pros and cons carefully before trading.

The Final Word

As DeFi continues its transformative journey in reshaping financial systems worldwide, it is clear that well-designed liquidity pools form an indispensable part of this technological revolution. We can expect more innovative approaches to liquidity pools that bring about economic inclusivity and create new avenues for wealth creation in the digital age. This will lead to increased stability, making DEXs more appealing as viable alternatives to centralised exchanges for both experienced traders and newcomers alike.

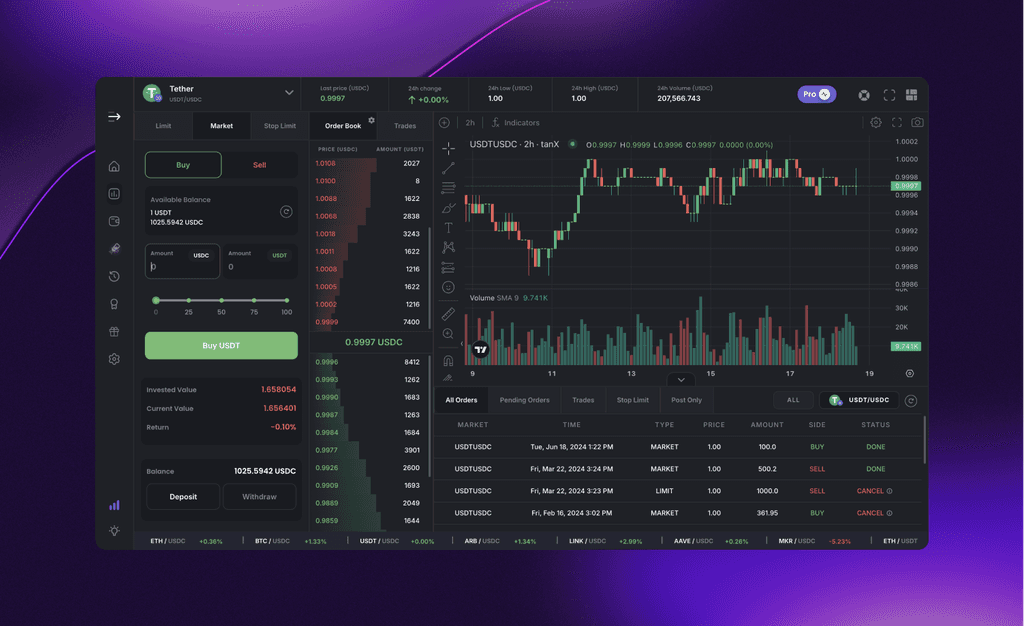

Tired of all the theory? See liquidity in action by trading on tanX, the superior DEX!

Get Started with trading on the world's leading insto DEX right away!