Christine George

Industry

5

min read

Jan 15, 2024

If you read the news today, you would have seen the term ‘BTC ETF’ thrown around at least a few dozen times. So what are we (or rather the US market) commemorating exactly?

The SEC (Securities and Exchange Commission) approved the listing and trading of spot bitcoin ETF (exchange-traded fund) shares on January 10, 2024. For the uninitiated, spot ETFs allow investors to gain direct exposure to an asset without holding it. The approval comes a decade after the first proposal, which makes it one of the most anticipated developments in the crypto sphere. The fact that a lot of previous applications (including the first one) were rejected outright because the SEC believed that the unregulated nature of bitcoin was inherently risky for investors, makes this victory a lot sweeter. It also marks a significant milestone for the crypto industry and is predicted to bring in more investors.

Let’s take a look at how ETFs could change the landscape of crypto trading positively:

Increased Accessibility: The ETFs purportedly create a convenient way for individuals and institutions to gain exposure to Bitcoin within the existing financial system, without directly buying and storing the cryptocurrency themselves. This could attract significant capital, potentially boosting Bitcoin's price.

Enhanced market legitimacy: As we have seen in recent times, the SEC isn’t the biggest fan of BTC. That being said, approval from a powerful regulatory body such as the SEC provides a solid seal of approval for Bitcoin, which could boost public trust and confidence in crypto, leading to wider institutional adoption.

Regulation: Since the SEC has approved it, both the ETF and the fund behind it will be regulated, i,e., they will be audited regularly to ensure fair practices. This should put traders who are used to the regulated nature of centralised exchanges and traditional finance at ease.

That being said, spot ETFs also come with their own set of drawbacks, including higher management fees and possible price fluctuation. But regardless of the implications, there is no doubt this will increase awareness for BTC and crypto, in general.

Why do we need a spot ETF when a Futures ETF already exists?

Spot ETFs differ from Futures ETFs in several key aspects. While Futures ETFs convey the right to buy or sell an asset at a predetermined price for delivery at some point in the future, the contracts do not indicate ownership of the asset itself. On the other hand, in the case of spot ETFs, the fund manager who provides the ETF actually owns and manages a large pool of the asset. This eliminates counter-party and futures de-pegging risk due to erratic price swings.

Impact on the Market - How could the market move and why?

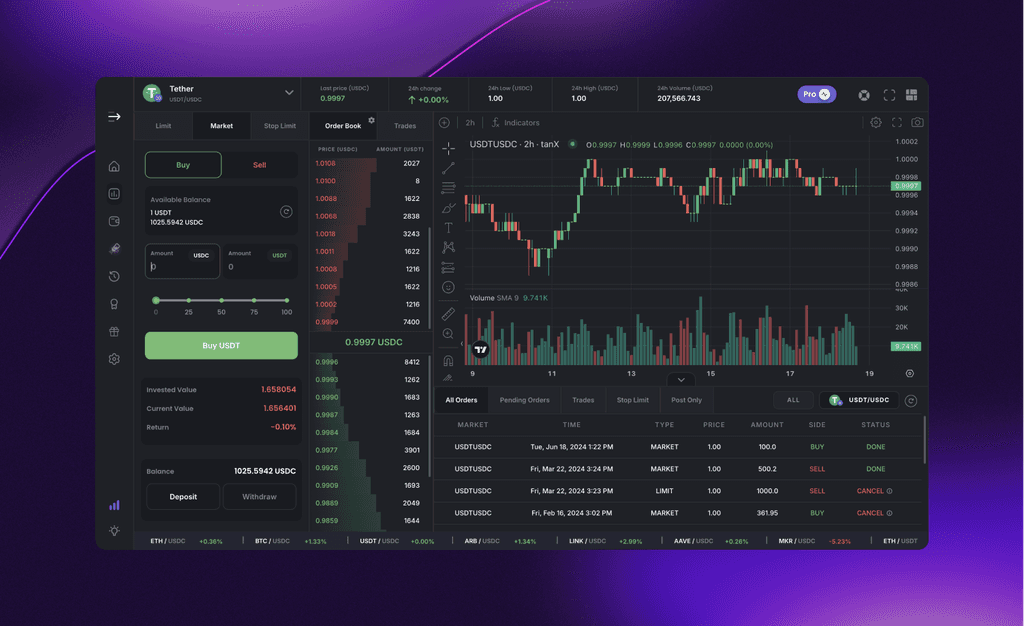

So how will the spot ETF approval influence the market? Aryan Chandel, trading advisor at tanX, shares his insights and offers possible theories.

In the past, launches have proven to have mixed reactions from the market. Some analysts have posited that institutional demand will necessitate a large-scale purchase of BTC, leading to a radical shift in supply and demand.

Here are a few examples:

CME BTC Futures listing date - Dec 18, 2017

Coinbase IPO listing - Apr 14, 2021

BTC Futures ETF listing date - Oct 19, 2021

Current market structure

Currently, we're approaching three significant resistance zones :

Firstly, we are near the ~$48,200 historic resistance level. BTC faced this resistance back in March’22 after which it dropped ~63% in the next 3 months.

Secondly, we're also hovering near the 0.786 Fibonacci level of the previous correction that took us from ~$69,000 to all the way ~$15,500. Fibonacci levels of 0.382, 0.5, 0.618 and 0.786 often trigger price pivots, hence, this is a crucial zone to monitor.

Lastly, since September '22, BTC has been following a well-defined parallel channel, marking key turning points, including the low of ~$15,500, the swing top of ~$31,000, and the swing low of ~$24,900. Presently, we find ourselves in close proximity to the resistance line of this parallel channel.

Successfully breaching these resistance levels could pave the way for an all-time-high above $69,000. However, should these resistances exert downward pressure, a healthy correction of ~20% might be on the horizon.

Get Started with trading on the world's leading insto DEX right away!