Sharad Jaiswal

Industry

2

min read

Apr 27, 2024

The financial sector has been experiencing a seismic shift as cryptocurrency and blockchain technology gain traction; the global crypto market cap surged past $1 trillion in 2021. This technology has immense potential for increased transparency, reduced costs, and new revenue streams, so it's no surprise that many traditional financial institutions (FIs) are exploring ways to capitalise on it.

A recent survey by Citi revealed that ""88% of institutions exploring digital assets, blockchain, DLT "". But before diving into this exciting new frontier, financial institutions must be aware of the challenges that lie ahead.

Navigating the Cryptoverse: Challenges for FIs

Regulatory Maze: The regulatory landscape surrounding cryptocurrencies is complex and constantly developing. This ambiguity makes it challenging for FIs to navigate compliance requirements and ensure they stay on the right side of the law.

Top-Tier Security: Security is paramount for FIs, but traditional protocols might not be sufficient to overcome the unique challenges posed by digital assets. Cutting-edge solutions are needed to protect crypto assets from cyberattacks and potential breaches.

Integration Hurdles: Integrating cryptocurrencies into existing FI infrastructure can be a mammoth task. The lack of technical expertise required to achieve seamless integration can be a significant barrier to entry.

Obscure Ecosystems: The volatility and anonymity associated with cryptocurrencies can make risk assessment difficult for FIs, which can hinder adherence to KYC/AML (Know Your Customer/Anti-Money Laundering) regulations.

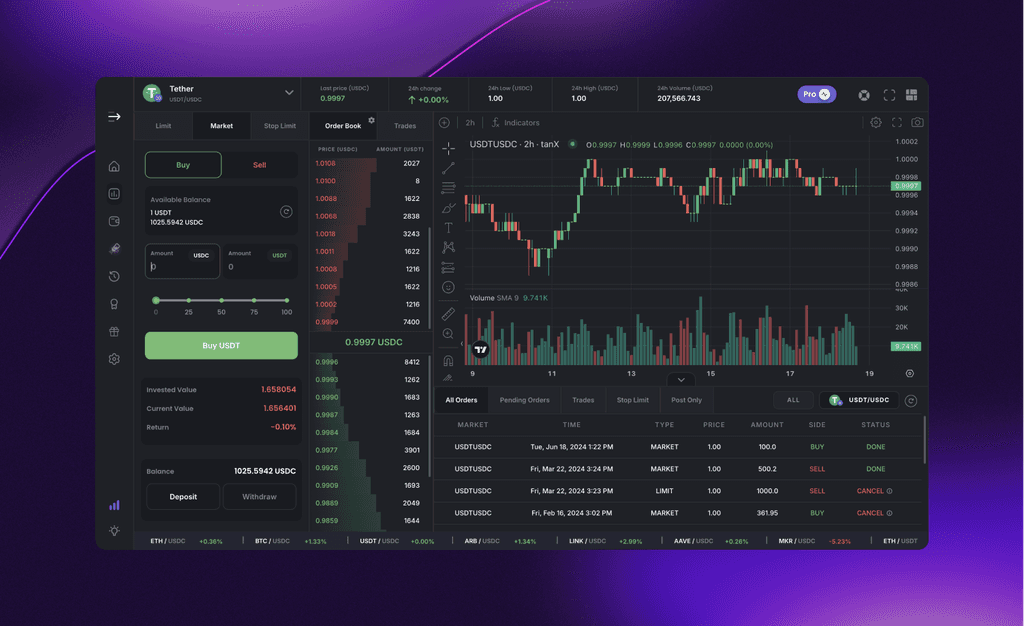

tanX: Your Secure Gateway to the Crypto World

tanX.Fi, a game-changing cross-chain orderbook DEX, is designed to simplify and secure crypto trading for users. Here's how tanX empowers FIs to navigate the complexities of the crypto space:

Resilient Security: tanX Fi prioritises security. Its gasless, trustless, and secure environment offers a robust platform for FIs to trade crypto assets with minimal counterparty risk. This translates to peace of mind for FIs venturing into the crypto realm.

Built-In Transparency: Leveraging the power of blockchain technology, tanX provides an immutable and transparent record of all transactions. This fosters trust and simplifies compliance for FIs, allowing them to meet regulatory requirements with greater ease.

Streamlined Integration: tanX offers seamless integration with prevailing infrastructure to significantly reduce the burden of adopting cryptocurrencies. This allows FIs to leverage their existing systems when venturing into the exciting world of crypto.

Beyond the Challenges: A Brighter Future

By addressing the key challenges faced by FIs, tanX paves the way for smoother crypto adoption within the financial sector. A secure, transparent, and user-friendly platform like tanX Fi can bridge the gap between traditional finance and the burgeoning world of cryptocurrencies.

By leveraging cutting-edge technology like zero-knowledge proofs and optimistic rollups, tanX enables financial institutions to trade cryptocurrencies across multiple blockchains without the need for gas fees or costly on-chain settlement. This not only reduces operational costs but also minimises the carbon footprint associated with traditional blockchain transactions. (Ethereum's average gas fees peaked at over $200 in May 2022.)

Moreover, tanX's trustless architecture eliminates the need for centralised intermediaries, addressing concerns around counterparty risk and censorship. This decentralised approach aligns with the core principles of blockchain technology, promoting transparency and reducing the potential for manipulation or interference. Over $2 billion worth of funds have been lost due to crypto exchange hacks and exploits in 2022 alone.

Facilitating Mainstream Adoption

As regulations around cryptocurrencies continue to evolve, with over 100 countries exploring central bank digital currencies (CBDCs), platforms like tanX that prioritise security, scalability, and compliance will likely play a pivotal role in facilitating the mainstream adoption of crypto by financial institutions. By addressing key challenges and offering a streamlined solution, tanX is poised to become a catalyst for institutional involvement in the dynamic world of digital assets.

Conclusion: Looking Ahead

The future of finance will be impacted by the rise of crypto. As regulations evolve and the technology matures, FIs that embrace crypto stand to gain a significant competitive advantage. tanX Fi is poised to be a valuable partner in this exciting journey, empowering FIs to securely enter the crypto space and unlock its vast potential.

tanX Fi's website offers a wealth of information about its features and functionalities. Let’s dive into tanX website today to know more.

Disclaimer: The information provided here is for informational purposes only and does not constitute financial advice. Please conduct your own research before making any financial decisions.

Get Started with trading on the world's leading insto DEX right away!