Christine George

Industry

4

min read

Jul 15, 2024

You've got the capital; now what?

Ever wondered whether to invest your hard-earned money drop by drop or in buckets?

This blog dives into the two main strategies for entering the investment game: Dollar-Cost Averaging (DCA) and Lump Sum investing. We'll break down the pros and cons of each, so you can decide which approach best suits your financial personality and goals.

Dollar-Cost Averaging vs. Lump Sum Investing: Which One Should You Choose?

Let's break down each approach to see which might be a better fit for you.

The Dollar-Cost Averaging Approach

Think of DCA like buying groceries every week. You invest a fixed amount at regular intervals, say every month. This way, you buy at different price points, potentially averaging out the cost per share over time.

Pros:

Reduces risk of bad timing: Worried about investing right before a market dip? DCA helps you avoid this "timing risk" by spreading your investment out.

Discipline and Consistency: Setting up automatic deposits makes for a disciplined investing routine, perfect for those who prefer a set-it-and-forget-it approach.

Cons:

Potentially Lower Returns: Historically, lump sum investing has led to higher returns on average. With DCA, your money sits uninvested, missing out on potential growth.

The Lump Sum Investing Approach

This strategy is like buying all your groceries for the month in one go. This approach gets your money working for you right away, potentially maximising long-term gains.

Pros:

Potentially Higher Returns: By getting your money in the market sooner, you can potentially benefit from compound interest for a longer period.

Simpler to Manage: Since it is a one-time investment, you don't need to worry about setting up or maintaining regular contributions.

Cons:

Timing Risk: If the market dips right after you invest, your portfolio value will follow suit and decrease in value.

Which One is Right for You? 🤔

The answer depends on your risk tolerance and investment goals.

Dollar-Cost Averaging might be better if: You're a new investor or have a lower risk tolerance. You prefer a more hands-off approach with automated deposits.

Lump Sum Investing is a good choice if: You have a long-term investment horizon. You're comfortable with some short-term market volatility. You have a lump sum ready to invest and don't want to wait.

The Final Word

Remember - there's no one-size-fits-all strategy. Carefully analyse your financial situation and investment goals before deciding. Consulting with a financial advisor is also a smart move!

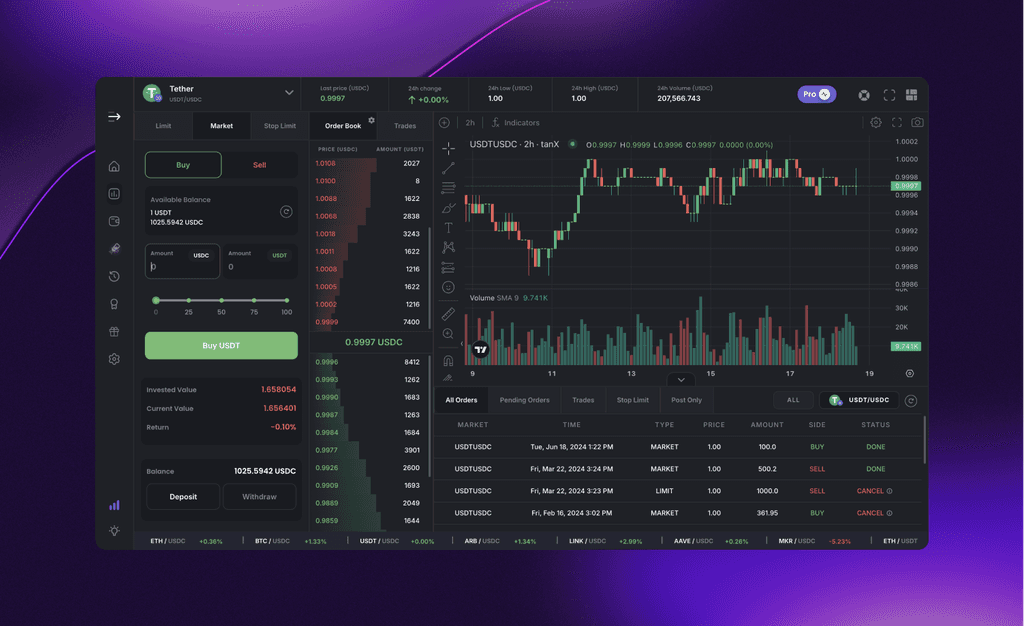

Get Started with trading on the world's leading insto DEX right away!