Christine George

Industry

4

min read

Jul 30, 2024

Key Takeaways

Crypto wallets are essential for managing digital assets. They don't store cryptocurrencies directly but manage public and private keys.

Hot wallets offer easy access but could be vulnerable to hacking. They include mobile, web, and exchange wallets.

Cold wallets provide enhanced security by storing private keys offline. They come in hardware, paper, and offline software forms.

Choosing the right wallet depends on factors like security needs, technical expertise, asset type, and portfolio size.

The future of crypto wallets might include innovations like user-friendly interfaces, cross-chain support, DeFi integration, and advanced security features.

Ever wondered where your Bitcoin lives? The answer is: nowhere and everywhere.

Allow me to explain - unlike traditional currencies, cryptocurrencies don't physically exist. They're records on a blockchain, a decentralised digital ledger. To access and manage your crypto assets, you need a crypto wallet. And with an increasing number of people investing in digital assets, understanding how to store them securely becomes very important.

But what exactly are crypto wallets? What are the different types? And how do you choose the right one for you? You’re at the right place to find out - let’s dive in!

What is a Crypto Wallet?

Contrary to popular belief, a crypto wallet doesn't actually store your cryptocurrencies. Instead, it's a software program that manages your public and private keys.

All wallets are not created alike - there are various types of crypto wallets, each offering different levels of security, convenience and control. In this section, we’ll take a look at the primary classifications - hot wallets and cold wallets.

Hot wallets

When someone refers to a ‘crypto wallet’, chances are they’re talking about a hot wallet. These wallets are connected to the internet (or another device), offering easy access to your funds. However, this also means they are more susceptible to hacking.

There are different types of hot wallets:

Mobile wallets: These are apps on your phone which provide portability and ease of use.

Web wallets: These are accessed through a browser; they are more convenient but less secure.

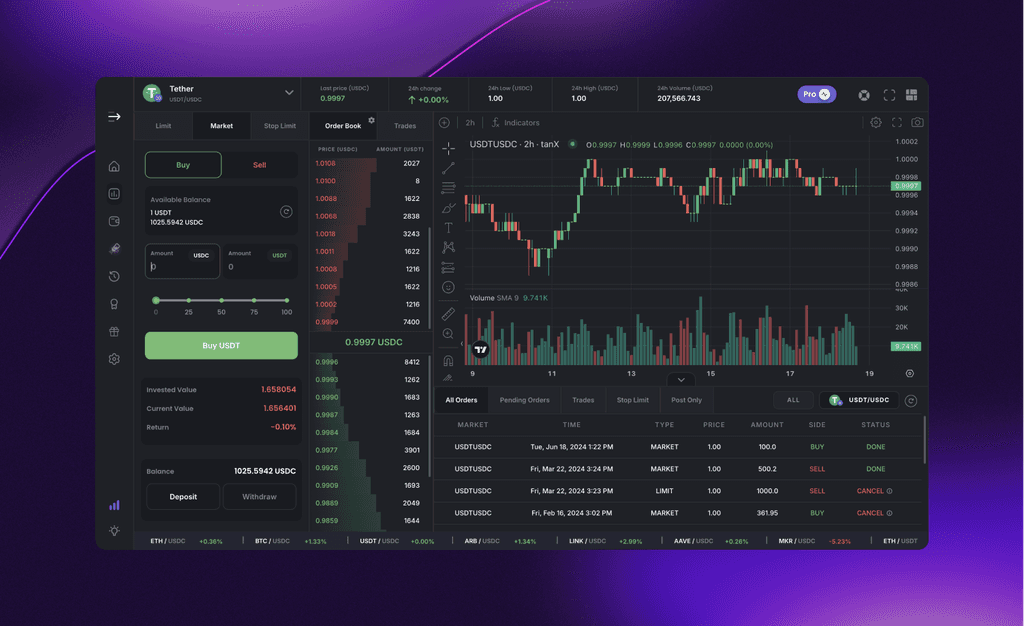

Exchanges: Certain platforms offer the option of online wallets or vaults where you can store your keys.

Cold wallets

These wallets, also known as cold storage, are considered a very safe method for storing digital currency as they are offline storage solutions.

There are various types of cold wallets too:

Hardware wallets: These are devices which store private keys offline; they can be connected to a device or network when required and then disconnected.

Paper wallets: This is a printed document containing your public/private keys.

Offline Software wallets: These programs create wallets on devices which are off the grid, and can generate and store private keys safely.

Choosing the Right Crypto Wallet

Now that you’ve learned about all the options you have, you might be eager to say:

But don’t be hasty - selecting the crypto wallet that’s most ideal for you involves evaluating multiple factors including security priorities, your technical expertise, what asset you hold, how much your portfolio is worth and many more. However, here are a couple of things to keep in mind:

If you have a significant amount of crypto that you’re not planning to use frequently, a cold wallet might be a better option. For smaller amounts that are often used or traded, a hot wallet is a better idea.

Desktop and hardware wallets offer more control over your funds, while web wallets and exchanges enable flexibility and ease of use.

The Future of Crypto Wallets

The crypto landscape is constantly evolving, and so are crypto wallets. We can expect to see more innovative wallets emerging in the near future, which offer user-friendly interfaces, cross-chain support, integration with DeFi protocols and advanced security features.

The Bottom Line

So, there you have it! Hot and cold wallets – each with their own perks and pitfalls. Now it’s up to you to decide which one is the best fit for your personal crypto journey. No matter which one you choose, remember to stay SAFU by always being cautious and prioritising security.

Here are some basic tips to get you started:

Use strong and unique passwords for your wallet.

Create regular backups of your wallet and store them securely offline.

Be cautious of suspicious emails, links, or messages that ask for your private keys, as they could be phishing attempts or scams.

Use two-factor authentication (2FA) whenever possible to add an extra layer of security to your wallet.

Ensure your wallet software is up-to-date with the latest security patches.

Diversify your holdings across multiple wallets to minimise risk.

Get Started with trading on the world's leading insto DEX right away!