Ram Kumar

Industry

5

min read

May 5, 2024

Have you ever had to explain something related to modern technology to your grandfather? How facetime works, that wifi signals won’t harm humans, what crypto is, a CEX vs DEX comparison and……. if CEX isn’t just misspelt.

No? Just me?

Because this is what I found myself doing in my recent trip to my hometown. I had to explain what crypto was about and how Centralised and Decentralised trading platforms were different from each other, and that is what this article will be about; explaining what CEX and DEX is, and the differences between them in such a way that your grandparents won’t ask you more than once like mine does, and it is about a certain ‘purple pill’ you need to know about at the end of this article.

On a pursuit to save us from this.

What is a CEX (Centralised Exchange)?

A Centralised Exchange (CEX) is a platform which enables you to trade in any blockchain, it is probably the first platform you will use to interact with blockchain when you’re a newcomer. This is because it is very similar to traditional finance trading platforms, i.e. there is a centralised authority running the platform with access to your funds and information about you due to KYC norms.

What is a DEX (Decentralised Exchange)?

A Decentralised Exchange (DEX) on the other hand, is a trading platform with no central authority or KYC requirements. It is usually maintained with the help of smart contracts and DAOs, also called Decentralised Autonomous Organisations, where the community gets to participate in decision making.

Comparison (CEX vs DEX)

Let’s compare the characteristics of both CEX and DEX; the categories we will compare them on are as follows:

Custody

Security

Liquidity

User Experience

A few minor aspects

Custody: Since CEXs are centralised, they have total access to your funds and trades, and this doesn’t guarantee the safety of your funds if the CEX is hacked or it goes bankrupt. DEXs stay true to the original motto of cryptocurrency; to give you have total control of your funds.

Liquidity: CEXs have an upper hand when it comes to liquidity due to their large user base, trading pairs, tools, features; the central body also ensures that the required liquidity is always met. DEXs, meanwhile, rely on users and liquidity providers for the same, which may lead to lack of liquidity in rare cases.

Security: DEXs are considered more secure due to their decentralised nature, funds of users are not concentrated in a central point like it is with CEXs, and that is a huge plus point for DEXs over CEXs when it comes to security. However, you should know how to differentiate between a secure and insecure exchange (whether CEX or DEX) to ensure your assets are in a safe paltform.

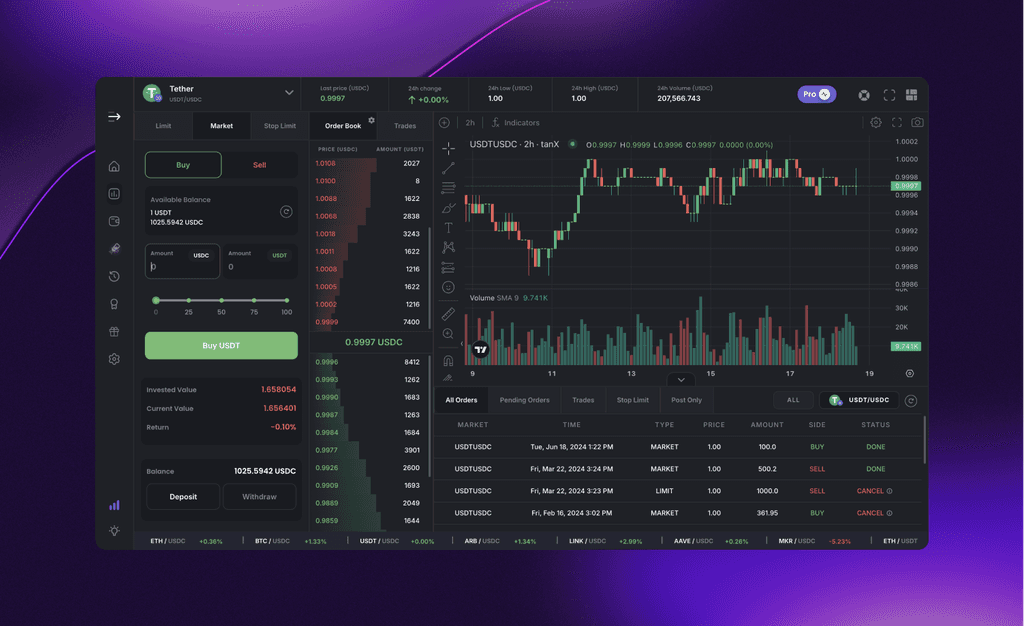

User Experience: CEXs offer a simple user interface with a wide range of tools and features that allow you to make the best use of the platform. This attracts most newcomers to CEX over DEX. probably why your grandpa might force you to choose a CEX. DEXs are not as user-friendly given their complex nature. They often need you to maneuver through various authentication protocols, and interact with smart contracts to trade. However, many DEXs are buidling to make their platforms simpler and easier to use, to attract newer users; and this is one of the places where we (tanX) excel.

Other factors: Other factors of comparison include:

Regulatory framework: Although we do not have a clear regulatory framework for cryptocurrencies yet, CEXs are actively working with regulatory bodies to establish a framework that benefits both parties. DEXs, however, do not fall under most regulatory bodies due to their decentralised nature; at least, not yet.

Privacy: Since there are no KYC obligations in DEXs, they do not have access to your personal information and so have an upper hand over CEXs that employ KYC and AML.

Speed: CEXs are faster due to their increased liquidity, centralised control system, complex yet streamlined matching algorithms helping them execute trades faster. DEXs are slower, but some DEXs are buidling on various solutions like rollups to quicken the process.

Fees: In this aspect, DEXs are generally costly, although various solutions like rollups are enabling DEXs to challenge CEXs in terms of affordability. tanX, for example, is a gasless DEX that charges just 0.04%, compared to a much higher 0.1% that Binance charges for Spot trading.

Conclusion (Or is it?)

Both CEX and DEX couldn’t be more different from each another, people choose each for their own distinct perks. Now that you and your grandparents have clearly understood the difference, you guys can choose the right platform for you.

If you are still confused, remember that it just boils down to two things; if ease of use and centralisation is what you are comfortable with, CEX is where you go, but if you are interested in having control over your assets and identity, DEX is the right choice for you.

Does this seem like a red pill/blue pill situation to you?

Because it does seem so to us

However, what would you do if there was a purple pill?

(Purple= Red + Blue, i.e. an exchange that brings to you the best of both worlds)

If it existed, a purple pill should contain the following characteristics:

Self-Custody

Simple and User-Friendly UI

Highly Secure

Low Fees

Do you know of any exchange that can be a purple pill?

Conclusion (Really concluding this now!)

Funny how we were just talking about a ‘purple’ pill, because I just realised, purple is one of tanX favourite colours, it is everywhere in our website!

This is an actual coincidence! Don’t believe us? Read on!

Because what is not a coincidence is that tanX is buidling to be the purple pill! We are a DEX that boasts of a simple and user-friendly UI along with an orderbook, and gasless trading to help our traders increase profits, bringing to you the best of both worlds.

Told you it was a coincidence!

Get Started with trading on the world's leading insto DEX right away!