Christine George

Product

3

min read

Nov 15, 2023

Cryptocurrencies are taking the world by storm, and for good reason - they facilitate online transactions in an easy and efficient way without the need for intermediaries or central authorities like banks. And one of the best ways to trade securely is through decentralised exchanges (DEXs) which have been gaining popularity in the world of crypto trading due to their superior features.

Within the realm of DEXs, one contender looks promising - the orderbook DEX. What exactly is an orderbook DEX? Let’s break it down.

An orderbook is a dynamic list of all the buy and sell orders for a particular asset. In a centralised exchange (CEX), the orderbook is maintained by the exchange itself. However, in a DEX, it is maintained by the users who create the orders themselves.

In this guide, we’ll take a closer look at the benefits of using an orderbook DEX and why it’s worth considering for your crypto trading needs:

Decentralisation: To start off, an orderbook DEX offers the obvious advantage of decentralisation. Since there is no central entity controlling the exchange and funds are stored on the blockchain, there is no single point of failure which can become a target for hackers. Orderbook DEXs are, thus, more resilient to thefts or security breaches.

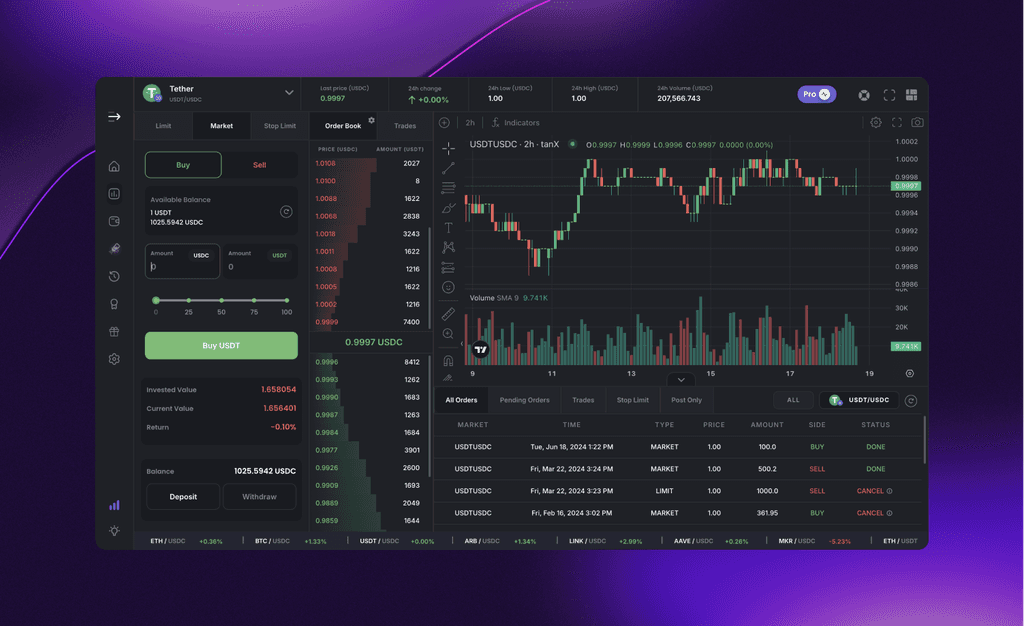

Economy: Another major merit of using an orderbook DEX is that they typically offer lower fees than their centralised counterparts. Because there is no middleman, users can save money on transaction fees, which can be quite beneficial for those who trade frequently or with large amounts. In fact, tanX is gasless; users don’t pay gas fees, only a transaction fee of 0.1%.

Transparency: With a CEX, you can never be sure if the exchange itself is playing fair with the orderbook. For example, they might place orders or manipulate prices to serve their own interests. However, with a DEX, all transactions are stored publicly on the blockchain, so there is complete transparency; anyone can look at the orderbook and verify that all trades are legitimate.

Autonomy: Orderbook DEXs allow you control over your trades. Both buyers and sellers can submit their preferred prices and quantities that they're willing to buy or sell at. This provides greater flexibility and freedom as you don't have to wait around for someone to accept your bid or ask price - you can submit limit orders instead, funding your crypto wallet and placing an order at your preferred price point. Additionally, if a certain asset is not available for trade on a centralised exchange, it may be available on an orderbook DEX. This gives users access to a wider range of assets.

Of course, there are also some downsides to using an orderbook DEX. The user interface may be more difficult to navigate for beginners, and the liquidity may be lower than a centralised exchange, which could mean that it takes longer to buy and sell your assets. They may not be the best choice for everyone, but they are worth considering for those who prioritise security, transparency, and control in their trading.

The Final Word

In conclusion, DEXs, specifically orderbook DEXs, can offer a host of benefits for those who want a safer, cost-efficient and private way to trade crypto. There is a slight learning curve you may experience when switching from the traditional CEXs, but trust us – once you realise the benefits, you won't want to go back.

As far as orderbook DEXs go, tanX is one of the most promising platforms on the market. Fueled by a team of young geniuses, it is an instant, secure and trustless DEX that offers the amazing features of gasless trading, along with a unique P&L analysis tool that helps you monitor and enhance your financial journey. Start trading on tanX, and experience the freedom and flexibility for yourself!

Get Started with trading on the world's leading insto DEX right away!