Christine George

Community

3

min read

Jul 3, 2024

Ever felt like this when trading crypto? Don’t worry - you’re not alone 🫂

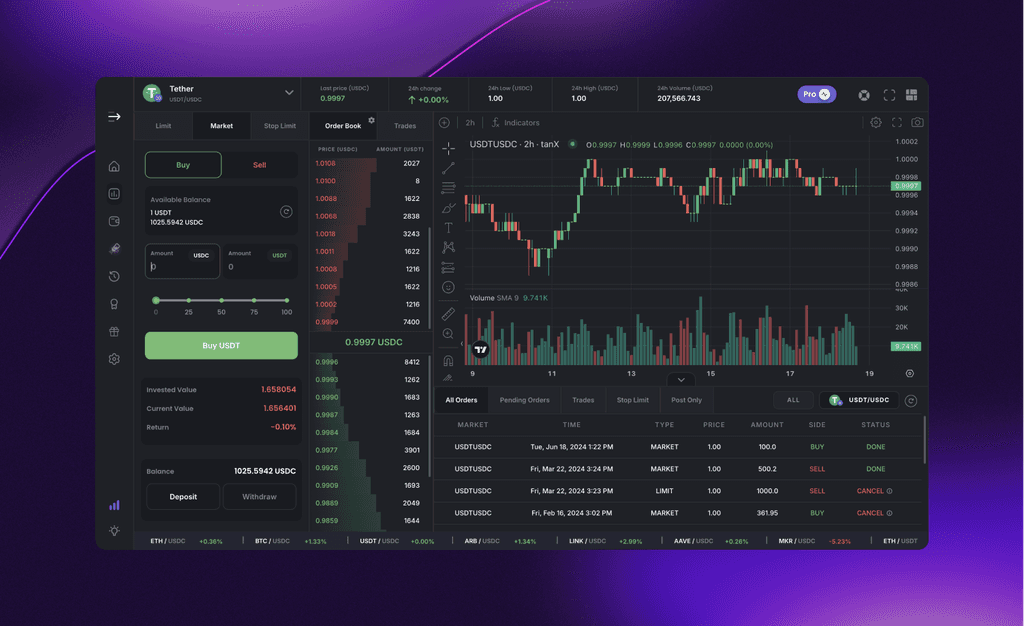

The crypto market can be tricky and overwhelming, especially for novice traders. You could make it easier by using market indicators and technical analysis.

What are market indicators?

Market indicators are tools used by traders and investors to analyse past price movements and identify potential future trends. By understanding these indicators, you can gain valuable insights into market sentiment and make more informed investment decisions. However, it's crucial to remember that indicators are not crystal balls, and they should be used in conjunction with other forms of analysis.

Are market indicators different from technical indicators?

Market indicators are actually a subset of technical indicators, as both are computed using statistical formulae and quantitative methods. Here’s a look at what sets them apart:

Types of market indicators

Here are some of the popular market indicators used by investors and traders:

Moving Averages: Moving averages are commonly used to understand price trends in the stock market. They are essentially an average price of a stock or index plotted as a single line on a chart. Investors analysing broad market movements often use longer moving averages (like 50-day or 200-day), while traders might focus on shorter timeframes.

Market Breadth: Market breadth indicators take note of stocks whose price movement is in the same direction, which is useful for traders who follow the broader market trend. Some indicators even look at how many stocks are above or below a specific moving average to gauge the market trend.

Market Sentiment Market sentiment indicators determine investor mood and if the overall market is bullish or bearish.

Put-Call Ratio: This compares the trading volume of put options (betting on prices going down) to call options (betting on prices going up). A ratio above 1 suggests more bearishness, while a ratio below 1 indicates bullishness.

VIX (Volatility Index): This measures market volatility. A high VIX suggests uncertainty and bearishness, while a low VIX suggests stability and bullishness.

On-Balance Volume The on-balance volume indicator (OBV) aggregates volume-related data into a single flowing line. This indicator doesn’t predict price movements, but it confirms trends. An appreciating OBV indicates the price of the security is increasing, while a declining one signals the price is falling.

The Final Word

Whether you’re a trader or an investor, experienced or just a rookie, market indicators can be an useful tool to navigate financial markets and make informed investment decisions.

Remember, however, that successful investing requires a combination of knowledge, experience, and a healthy dose of caution. Here are some additional tips for using market indicators effectively:

Don't use just a single indicator: Use a combination of indicators and chart patterns to confirm your analysis.

Start with the basics: Don't overwhelm yourself by trying to learn too many indicators at once.

Understand limitations: Indicators are not foolproof, and false signals can occur.

Backtest indicators: Use historical data to see how they would have performed in the past. This can help you assess their effectiveness.

Don't rely solely on indicators: Always do your own research and consider your risk tolerance.

Happy trading!

Get Started with trading on the world's leading insto DEX right away!