Christine George

Community

4

min read

Dec 13, 2023

In the compelling world of crypto, where fortunes can be made and lost in the blink of an eye, it's easy to get swept up in the excitement and make decisions that could lead to regret.

Whether you're a seasoned crypto trader or a curious newcomer, it's crucial to be aware of the pitfalls that can ensnare even the most experienced investors. Being aware of them, understanding the nuances and implementing effective strategies can minimise risks and increase your chances of success in the ever-evolving world of DeFi.

In this article, we'll look at the common mistakes made by crypto users and learn how to navigate the DeFi landscape with caution and confidence.

1. Neglecting research

The golden rule of crypto is DYOR a.k.a. Do Your Own Research. This means not blindly trusting what others tell you, whether it's a friend, an influencer, or even a (seemingly) convincing website. This might seem like a no-brainer, but it’s common for eager traders to skip the lessons and jump in without acquiring a basic understanding of the fundamentals of trading and how the industry works.

It's important to arm yourself with knowledge, not just about blockchain technology and DeFi protocols in general, but also the specific project(s) you're considering investing in.

2. Assuming smart contracts are invincible

While smart contracts are inherently secure, they are not entirely immune to vulnerabilities and it is crucial to identify and mitigate potential risks. Smart contracts on blockchains like Ethereum are public and their code can be reviewed by anyone. Although smart contracts of DEXs are often audited by reputable firms that add an extra layer of security, it is still possible for bugs to slip past audits and code reviews.

Thoroughly review the smart contract code, assess the project's security audits, and stay informed about any potential vulnerabilities that may arise.

3. Falling for scams

I know what you’re thinking - how can a smart and well-informed person like me fall for a scam? Unfortunately, scammers are getting smarter too, and their schemes are evolving. An example of this is rug pulls; fraudulent projects deceive investors into purchasing tokens, only to abandon the project and abscond with the funds.

There is no sure way to stay safe, but there are steps you can take to prevent it to a certain extent. Always be wary of unsolicited messages, clickbait links, and projects that promise unrealistic returns or guaranteed profits. Don’t forget - if it’s too good to be true, it probably is.

4. Being unaware of front-running

Front-running is a form of market manipulation where malicious users exploit their position in the transaction validation process to gain unfair advantages. Miners or mining pools obtain a preview of transactions while confirming and validating them, and can use them to engage in front-running.

Try to understand how front-running works, stay alert, and choose DEXs like tanX that prioritise fair trading practices.

5. Forgetting that recovery is not an option

One of the salient features of DEXs is their decentralised nature, which means they do not have a KYC process or the option to cancel transactions. While this keeps user funds and assets safe, it also means that DEXs cannot recover misplaced or stolen funds. CEXs and other third-party entities offer custodial services that securely simplify asset management; in DEXs, users are responsible for managing their private keys. You cannot rely on a support team for a lost private key or missing funds either, as it is incompatible with the smart contract-based model of DEXs.

Losing your private keys means losing access to your crypto. So protect them with the utmost care, and consider using secure storage solutions for added peace of mind.

6. Succumbing to emotional investing

The two most powerful emotions in investing are fear and greed, and emotional investing is a big reason why so many investors buy at highs and sell at lows. Greed can push traders to buy the hottest token which surged over the past week, and fear of missing out (FOMO) can lead them to hasty purchases without conducting due diligence.

You should always be mindful of your emotions when making investment decisions; having a sound investment strategy and discipline will also reduce the risks of emotional investing.

7. Putting all your eggs in one basket

Spreading your bets is important, especially in a highly volatile market like crypto. If you invest all your funds in a single project, it could lead to potentially losing a significant portion of your investment if the project falls through. If your portfolio is diversified, when one token crashes, another might rise, cushioning the blow.

Diversify your portfolio across different coins and sectors to mitigate the impact of unexpected market swings.

8. Staying on a sinking ship

Have you heard of the Sunk Cost fallacy? It’s when a person is reluctant to abandon an approach or course of action because they’ve invested so much in it, whether it’s their time, money, or energy. This is commonly seen in crypto trading spheres as well; investors often cling to losing investments in the hope of a miraculous recovery.

Don’t let false hope get the best of you - recognise when a project is no longer viable and have the courage to cut your losses and opt out of unprofitable positions.

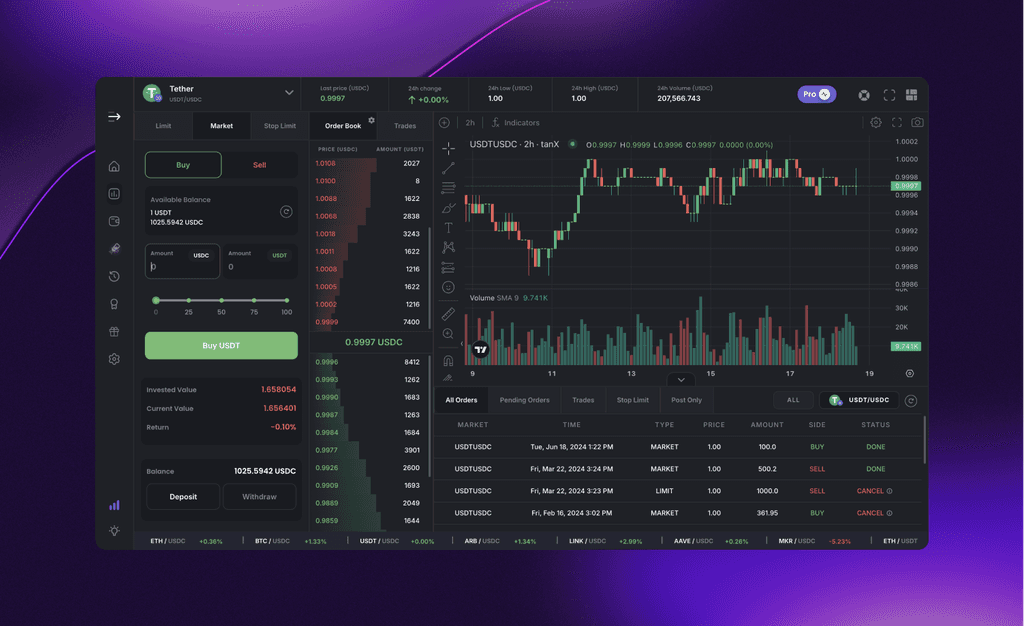

9. Using the wrong crypto exchange

The right trading platform will keep your funds safe, provide optimal trading conditions, and make trading easier, giving you peace of mind. The wrong one may cause frustration and put your assets at risk.

By doing your research and carefully considering your options, you can choose the best crypto exchange for your needs. We can help you out here - tanX has an established reputation of putting our users first, building our community and delivering top quality solutions.

The Final Word

We believe that the points mentioned above can help you learn about what not to do in crypto, and get you one step closer to making better returns in the space.

However, the biggest mistake, in our opinion, would be to not invest in crypto at all. While it is definitely a risky investment, it might pay off in the long run, especially if you are careful and sensible. Just remember - learn to walk before you run. #WAGMI

Keep learning, stay curious, and don't be afraid to ask for help!

Get Started with trading on the world's leading insto DEX right away!